Stay tuned to the latest in restaurant Ops & Marketing. We email 2-3 times per month.

Until 2010, the Full Service Restaurant POS business was a real snooze. MICROS, Aloha, Positouch and a handful of other companies dominated the industry for decades. Prices were high. Innovation was slow. On January 27th, however, perhaps without directly intending to, Steve Jobs and Apple set off a chain reaction that would disrupt the restaurant POS market forever.

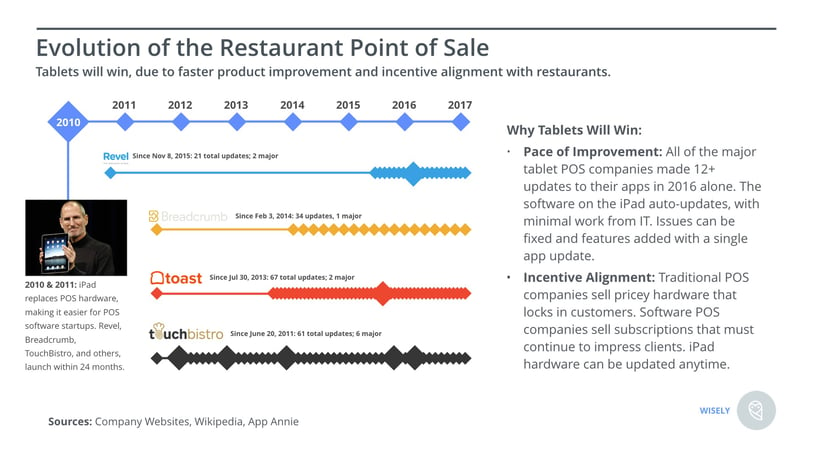

By the end of 2011, less than 24 months after the iPad launched, Revel, Breadcrumb, TouchBistro, Toast, and a handful of others had launched their first versions of their tablet-based restaurant POS. Given the opportunity to look back, we would bet that the founders of tablet POS companies would say their products were immature and not ready for prime time at that time, especially in Full Service Restaurants. But, over the ensuing 6 years, we've witnessed a classic innovators dilemma unfold before our eyes. The tablet POS systems became mature enough for coffee shops, then bars, then small retailers, all driven by rapid product updates that were automatically installed via the App Store or Play Store.

In general, yes, tablet POS systems are ready for prime time in Full Service. They have more up-to-date security, the same features as traditional players, more frequent updates, incentives to provide excellent customer support, come with more third party software integrations, and are far cheaper to install and maintain. The big plus that the incumbents have on their side is user familiarity—a substantial barrier for anyone to overcome—and switching costs.

Should your restaurant group adopt a tablet POS? The answer depends hinges on whether you think of the POS as a growth tool or just as an order entry device, and then of course, timing.

We believe that restaurants should make the change to a tablet POS as soon as it checks the all boxes required by FOH operations, for the list of reasons explained above. Second, the bigger the restaurant group, the more important it is for them to move quickly, because tech innovation can combat industry-wide same store sales declines, just ask Dominos.

Let's delve into a few key areas that separate tablets from traditionals.

Security:

For two reasons it is wrong to believe that older POSes have better security simply because they've been around longer. First, software updates often contain security upgrades, which means older software is, by definition, more vulnerable. Second, if your POS data resides on a computer at a restaurant, it's A) harder to update because a person may have to physically go there and do it, and B) harder to manage who has access to the computer. I've personally sat in many a restaurant office, and where employees are walking in and out of the room with the back of house POS terminal. Per Krebs on Security, in 2016, Oracle, who bought MICROS in 2014, said that it had "detected and addressed malicious code in certain legacy MICROS systems." (Emphasis ours) On the other hand, tablet POS systems can make security updates without requiring restaurant IT teams to lift a finger and are not located in the restaurant.

Cost:

Prices are cheaper on the new POS systems, and billed on a subscription basis over the life of the product. From a restaurant's perspective, it means that the monetary cost of switching is lower and POS company's incentives for providing a consistently improving product with great support are aligned—or you can quit! A new iPad ranges from $269 to $1129, a far cry from even a used MICROS or Aloha terminal. Over five years, the total cost of a tablet POS for a restaurant with 4 terminals restaurant would total $20-30k, with an additional ~$10k in up front setup fees. Pricing for a legacy system could be significantly higher.

Tools to Power Profit Growth:

From the outside, traditional POS companies seem to view their mission as facilitating order entry and kitchen display. On the other hand, tablet POS companies are focusing on the value add by unlocking the data in the POS. Upserve has unparalleled reporting out of the box. Revel, Toast, and TouchBistro have robust API and partner programs that enable POS data to easily tie into other FOH and BOH systems. By signing up for a tablet POS, you'll have access to a veritable App Store of other software that can be enabled with the click of a few buttons. Most of add-on tools have no upfront cost, and offer free trials to demonstrate their value to clients before they buy.

Incentives to Provide First-Rate Customer Support:

We've experienced first hand stories of bad support experiences for traditional POS companies (to remain nameless), and I've read about bad support experiences for just about every company, traditional and tablet-based. With that said, we strongly believe that having incentives aligned is crucial for predicting how a company will act. In the case of the tablet POS companies, they often lose money on the installation, and make money on the monthly fees. They understand that restaurants can switch to another tablet POS for relatively low cost—all it takes is downloading a new app and changing some settings. Therefore, if they want to keep customers, they need to deliver a high quality product and support it well. On the other hand, traditional POS companies make gobs money on the up front install, there are higher switching costs (due to hardware replacement and setup). There's a clear business model advantage for tablet POS companies, because it aligns with what the customer wants.

Opinions from Restaurant Operators:

"If you're a cutting edge brand targeting tech-savvy consumers, your technology sophistication should match your audience. We're excited to see how tablet usage evolves throughout the industry in the near future." - Head of new store openings for a fast growing, 25 location restaurant group that uses a traditional POS

"The place traditional POS companies win today is on intuitiveness, specifically how options and mods are laid out. However, the tablet POS companies are much cheaper, and get better with each update." - Owner of a 2 location midwestern restaurant group that currently uses a tablet system

"I would, without a doubt, choose a tablet-based POS. We have worked with legacy systems for many years. Legacy systems are usually connected to computers with outdated, slow operating systems. Tablets offer flexibility in placement, allowing operators to avoid electrical headaches and planning. Tablet-based systems offer a user friendly back-end platform that updates pricing and buttons in real time without having to restart your system. We wouldn't use the tablets to ring in orders in real time at tables but that could beneficial at the appropriate venue." - Director of Operations for an 11 unit restaurant group

Conclusion:

At the very least, we'd recommend that you take a sales call with the new POS companies and push them on the known risk factors: ease of use, support, stability. Ask them refer you to a client who has experienced an issue recently with their POS, and find out how from the client how well the POS company resolved the issue. For reviews on the main tablet POS systems, check out Capterra's Restaurant POS Software comparison.

Irrespective of whether a restaurant chooses a new school or old school POS, the restaurant POS industry is more competitive than ever. Restaurants and their guests will get the spoils.